Access equipment rental markets show differing responses to economic forces

24 June 2024

The mobile elevating work platform (MEWP) rental markets in Europe, the United States, and China displayed varying levels of growth in 2023, driven by high demand, improved rental rates, and investment in fleet expansion and greener technologies. This gave way to a generally positive outlook for 2024, despite persistent challenges including inflation, geopolitical uncertainties, and supply-chain issues.

The recently released 2024 IPAF Rental Market Reports take a deep dive into these markets, analyzing the factors and forces affecting access equipment rental throughout the world. Let’s take a close look at the key markets and what they’re facing.

Europe on the upswing

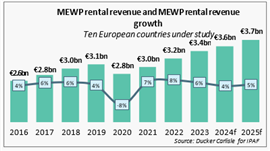

The European MEWP rental market reached a total revenue of €3.4 billion in 2023, experiencing robust growth across most markets, particularly in the non-construction sector.

This growth was underpinned by a 4% increase in GDP, marking a recovery from the previous year’s decline. The GDP outlook for Europe remains positive, with expectations of further increases in 2024 and 2025.

Construction output in the 10 European countries under study, however, decreased in 2023 and is expected to decline slightly again in 2024 before showing early signs of recovery in 2025.

The European MEWP fleet stood at approximately 357,000 units at the end of 2023. Utilization rates remained stable, partly driven by the limited availability of equipment in certain countries and partly by solid demand.

All European countries reported satisfactory utilization rates above the 60% mark, indicating a positive and stabilized market outlook.

Rental companies continued to invest in their fleets, catching up on renewal and expansion plans as lead times from MEWP manufacturers eased, and strong demand for environmentally friendly equipment persisted.

France retained its position as having the largest MEWP rental fleet, exceeding 71,000 units after growing by approximately 3,500 machines. Despite the strength of its fleet, France struggled with construction.

Germany followed with a fleet size close to 64,500 units, while the UK had almost 62,000 units.

Notable growth rates were observed in Spain (10%) and other major markets. The average revenue per unit increased to €9,597, with Germany maintaining the highest revenue per unit.

Investment in fleet renewal and expansion increased by 6% in 2023 compared to 2022. This investment was driven by high demand and the desire to transition to greener technologies.

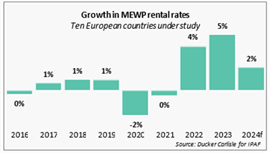

With unprecedented market demand and rising inflation and MEWP purchase prices, rental companies were forced to substantially increase rental rates in most European countries. The Nordic region, in particular, faced challenges, mainly due to consolidation activity increasing market competition, which suppressed rental rate increases.

The market outlook for 2024 remains positive, as manufacturer lead times are expected to stabilize further, and rental companies forecast continued healthy demand. However, as inflation is anticipated to ease in Europe, rental rate increases should slow down while an investment decrease is expected as rental firms plan more cautious spending to target margins over volume.

Speaking to the general economic outlook and construction activity, Europe’s individual economies represent a mixed bag of positive and challenged markets. Generally speaking, southern markets like Spain and Italy are outperforming northern countries, which are currently facing economic challenges.

“Countries sitting more centrally, including the major European economies of the UK, France, and even Germany have seen declines,” Youdale said, noting this is putting pressure on those rental markets.

Despite preparing to host the Paris 2024 Olympic Games later this summer, for example, French construction activity in 2023 fell to its lowest level in three years. Likewise, in Germany, residential construction is the biggest concern with new builds forecast to drop by 15% in 2024. In the UK, construction activity is set to fall by 2.1% this year.

“However, it’s not all bad, and reports from the rental sector are more positive,” Youdale stated. “Rental is bucking the trends in Europe somewhat, compared to the overall construction and economic slump.”

He added,” The advantage the access equipment sector has over general construction equipment is it can be used in a wider, more evergreen range of applications. Understandably, rental companies are seeking to take advantage of this by investing in more specialty equipment, rather than being stuck in the up and down cycle of construction.”

Tariffs on Chinese imports, however, could impact equipment prices and product choices for European rental companies.

US remains strong

In the United States, the MEWP rental market also saw substantial growth in 2023. US GDP increased by 7% in 2023, following an 8% increase in 2022, partially driven by strong performance across all construction sectors.

Construction output increased by around $20 billion, contributing to high demand in the MEWP rental market. The US MEWP rental revenue reached a record high of US$15 billion in 2023, growing by 10%. The fleet size expanded by 10%, totalling 857,861 units by the end of the year.

Utilization rates in the US remained at an all-time high of 73% on average. Despite improvements in lead times for new equipment from manufacturers, rental companies reported that sustained levels of demand combined with US tariffs on Chinese equipment maintained pressure on utilization rates.

Owing to increased levels of investment and easing equipment availability, the average age of the fleet showed a slight reduction in 2023.

High tariffs imposed on Chinese-manufactured machines continued to restrict the availability of some models in the market, increasing market pressure.

Rental rates increased by 5% in 2023 to compensate for the rise in MEWP procurement costs and inflationary pressures. Most companies expect further rental rate increases in 2024, although at a slower pace, as maintaining client relationships with high year-on-year increases becomes challenging.

“The markets in North America are expected to remain strong,” noted Youdale, referencing a statement by Tom Doyle, vice president of program development at the American Rental Association, who said in February that “Rental should benefit from the tailwinds from interest rates, inflation, improving supply, preference to rent, and government and private spending.”

Youdale added, “Indeed in May, the [ARA] updated its forecast for this year to show an increased growth projection of 9.7%.”

Growth industries like data centers, which the US leads in with $160 billion in new projects, are benefiting specialty rental in this market.

This is evidenced by the actions of large US-based rental companies, such as United Rentals, which acquired companies to expand its specialty offerings, including temporary roadway rental business, Yak Access. For its part, Herc Rentals noted key growth markets include semiconductor and data centers, public infrastructure and expansion of their own specialty product offering.

Meanwhile, Sunbelt Rentals expects its specialty rental business could amount to $5 billion in revenues by the end of its current five-year plan.

China looks to the future

The GDP of China decreased by around 1% in 2023, and the forecast for 2024 has been set at around 5%. The macro-economic outlook for 2024 and 2025 is generally more optimistic than 2023. Construction activity is expected to remain strong.

In 2023, the Chinese MEWP rental market experienced a significant revenue surge of 19.5% over the previous year. This growth, driven by fleet expansion and increased utilization rates, saw rental revenue reach 14,882 million RMB (€1,946 million). Despite this, rental rates continued to decline due to intensified competition, particularly in major cities in East and South China.

The total rental fleet in China expanded to nearly 530,000 units, primarily comprising scissors (73.5%) and booms (25%). The market is expected to grow further in 2024 and 2025, supported by opportunities in urbanization, maintenance, and emerging industries like renewable energy. However, rental companies are anticipated to be more cautious with fleet expansion due to economic uncertainties.

The average utilization rate increased to 71% in 2023, rebounding as lockdown measures eased and downstream projects resumed. Although rental rates are projected to continue declining, this decrease is expected to slow down, with regional differences in rate changes.

Overall, the market outlook remains positive, with steady demand driven by construction safety and efficiency awareness.

Positive indicators aside, Youdale said China’s generalist rental sector is a far cry from its counterparts in the US and Europe, as it struggles to achieve maturity.

“Having said that, the country’s largest rental companies have been growing at a huge rate. This is with access equipment specifically, while the generalist model has not properly got started.

“Overall, the access industry in China has been growing around 40% year on year. The forecast this time last year was for growth to slow over the next couple of years, due to the market becoming more saturated. That slowdown has already started.

“It’s not all down to saturation,” Youdale added. “The ongoing economic downturn in the country does not help, nor does the construction crisis, with there being around 390 million square meters of unsold residential property in China, according to national bureau statistics.

“Nevertheless, the future of the access industry in China is strong. Depsite wider downturns, emerging industries, such as wind power, solar energy and wider renewable energy solutions, have broad potential for aerial platforms.”

Adding to this, Chinese rental companies are looking to branch out to international markets, potentially having a significant effect on emerging access nations in Southeast Asia, the Middle East and beyond.

IPAF reports and webinar offer detailed analysis

For detailed analysis of European, US and Chinese markets, the 2024 IPAF Rental Market Reports are available now. IPAF manufacturer, supplier, distributor and rental company members can apply for a free copy of the relevant report by filling in the form at www.ipaf.org/reports; non-members are able to purchase the report.

A visual summary of the 2024 IPAF Rental Market Reports, presented by Theo Castel from analyst Ducker Carlisle, which produced the report, is available to watch in last week’s webinar. As part of the webinar, Euan Youdale, editor of Access International, provides insights into the global market. See below.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM