Read this article in French German Italian Portuguese Spanish

ERA Convention tackles the European Rental Outlook

29 May 2024

At the ERA Convention 2024 in Lisbon, industry leaders gathered to discuss the future of rental solutions, with a significant focus on the evolving European rental market.

Martin Seban, Director at KPMG, presented a comprehensive analysis of the current market and future projections for the equipment rental sector, highlighting both challenges and opportunities.

Macro-Economic Dynamics and GDP Outlook

Martin Seban began by addressing the macro-economic dynamics influencing the Eurozone. The GDP growth forecast for 2023-2024 has been revised downwards by 0.4 percentage points due to several factors:

- Ongoing energy market vulnerabilities, particularly in light of the geopolitical tensions in Ukraine and the Middle East.

- High interest rates and the tightening of monetary policies.

- Adverse developments in major trading partners such as China.

Despite these challenges, there are positive indicators. The NextGenEU program and the European Central Bank’s anticipated loosening of monetary policies are expected to provide some economic support.

For instance, the National Recovery and Resilience Plan (NRRP) is projected to inject up to €648 billion into the economy by 2027, significantly impacting GDP in countries like Spain, Italy, Portugal, and Poland.

Construction Sector Struggles

The construction sector, a major driver for equipment rental, is currently experiencing a downturn. The new residential market has seen a significant contraction, driven by declining consumer confidence and stringent monetary policies.

However, this has not been entirely offset by public infrastructure and energy-related projects. The EU funds allocated for energy efficiency, sustainable mobility, renewable energy, and network improvements are expected to become fully operational by the end of 2024, which may help stabilize the sector.

European Equipment Rental Market

In this context, the European equipment rental market is expected to slow down after experiencing a post-Covid-19 rebound.

The market, which saw significant growth in 2021 and 2022, is now stabilizing with a more modest outlook for the next few years.

The slower market growth will mostly be driven by residual inflation in some European countries and soft demand in other.

Martin Seban provided a detailed breakdown of the rental market by end-markets:

- Construction continues to account for 65% of the market, with civil engineering, residential, and non-residential sectors being the primary contributors.

- Non-construction sectors, including resources, manufacturing, and various services, account for the remaining 35%.

Market Outlook and Regional Variations

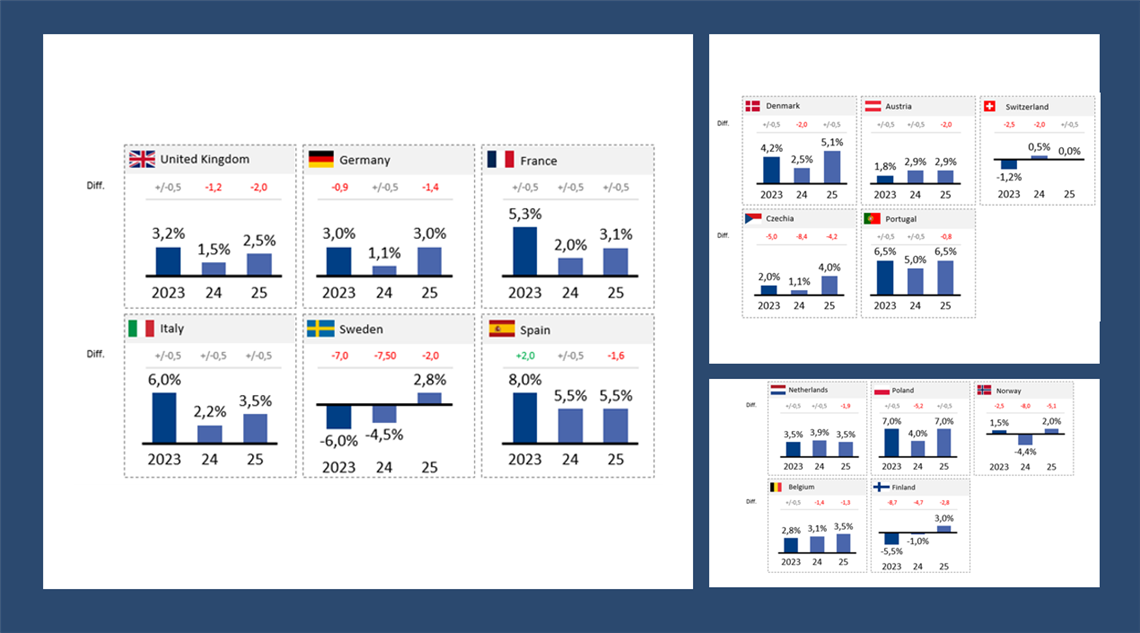

The market outlook varies significantly across different European countries. For instance:

- Spain and Italy have managed to maintain steady investment levels, thanks to continued EU financial support.

- Conversely, countries like Sweden, Germany, and the UK are facing slower activity levels due to factors like high interest rates, project delays, and weather conditions.

In countries with smaller markets, such as Portugal, Czechia, and Poland, infrastructure spending is expected to play a crucial role in maintaining activity levels.

Projects related to communication networks, road construction, renewable energy, and electricity infrastructure are anticipated to drive growth in these regions.

The market outlook for major European markets, showing the differences from the ERA Market report 2023 prediction:

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM