ERA/IRN RentalTracker survey: confidence down, but hope remains

27 January 2025

More than 120 companies took part in the ERA/IRN RentalTracker survey for the fourth quarter of 2024. Lewis Tyler analyses the key findings.

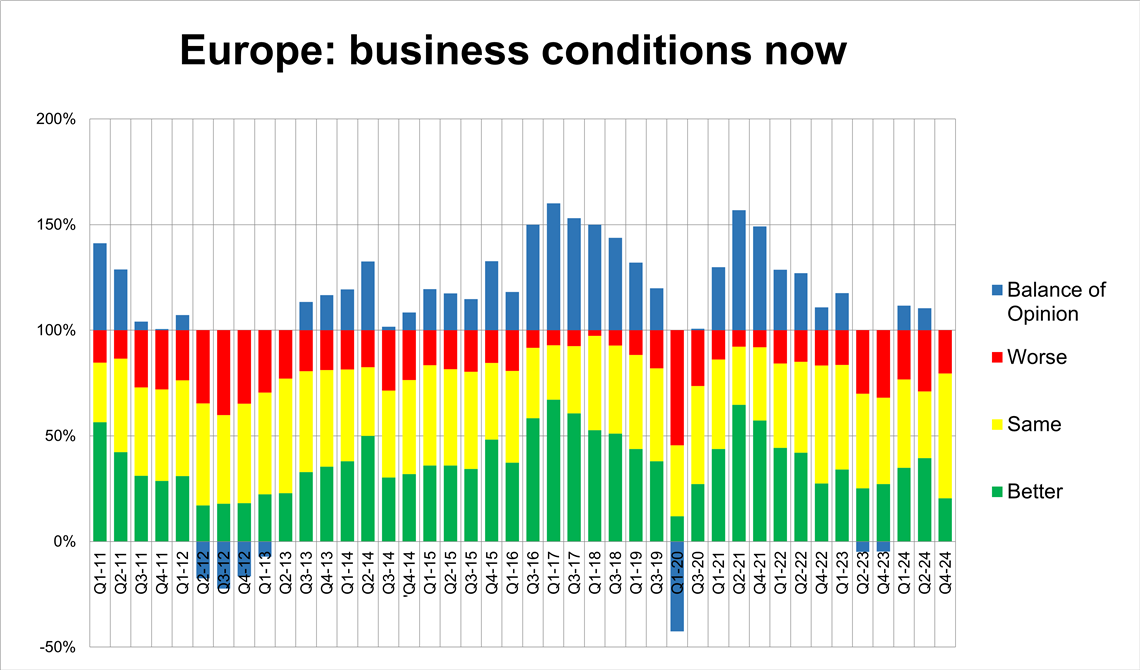

Rental confidence in Europe as measured at the end of 2024. (Image: IRN)

Rental confidence in Europe as measured at the end of 2024. (Image: IRN)

Business sentiment among equipment rental companies in Europe is continuing to decline, albeit with no sign of a collapse.

This is a key finding from the Q4 2024 ERA/IRN RentalTracker, conducted from mid-December to early-January

The survey, which received more than 120 responses, revealed that one in five companies (20%) reported a worsening of business conditions now, although 20% said that conditions are improving, resulting in an even balance of opinion.

With 60% of companies reporting stable conditions, there seems to be reasons for cautious optimism.

However, comparing responses in the second quarter of 2024, when the balance of opinion was +10%, indicates a slight deterioration in confidence.

Low construction activity and high interest rates are affecting business conditions across various regions in Europe, with some companies particularly feeling the pressure, it seems.

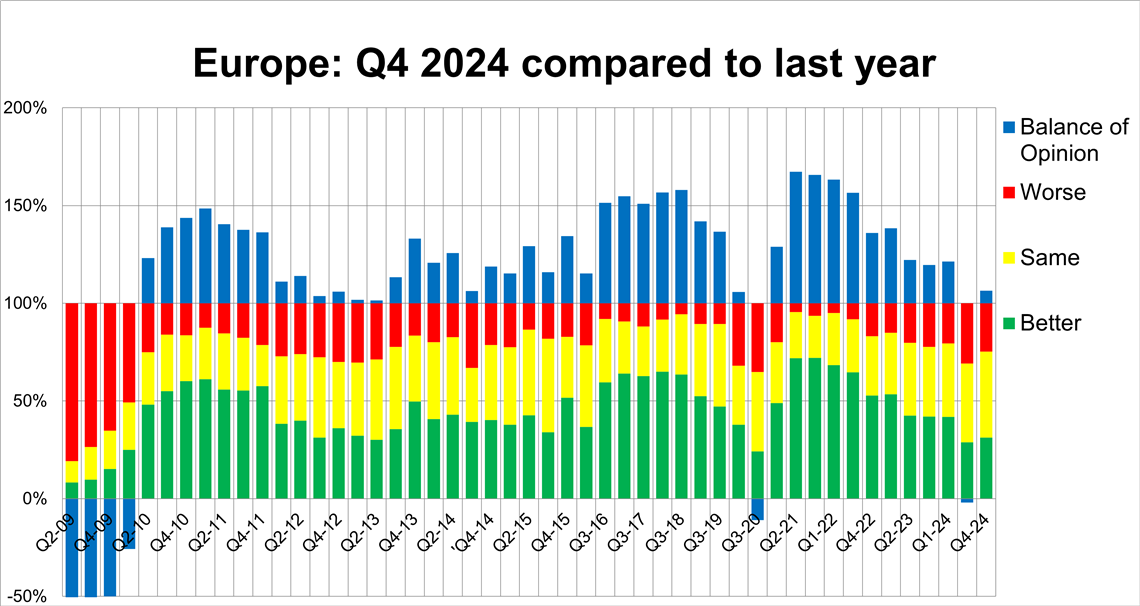

The survey does reveal some optimistic sentiments. For example, there was a +6% balance of opinion on Q4 market activity compared to the same period in 2023. That compares to a negative balance of opinion of -1.9% for the second quarter of 2024. Not a massive swing in sentiment, but a sign that there is hope for the future.

Rental activity in Q4 2024 compared to Q4 2023. (Image: IRN)

Rental activity in Q4 2024 compared to Q4 2023. (Image: IRN)

For Q4, 31% reported higher activity than the same quarter in 2023, while 25% said activity was lower.

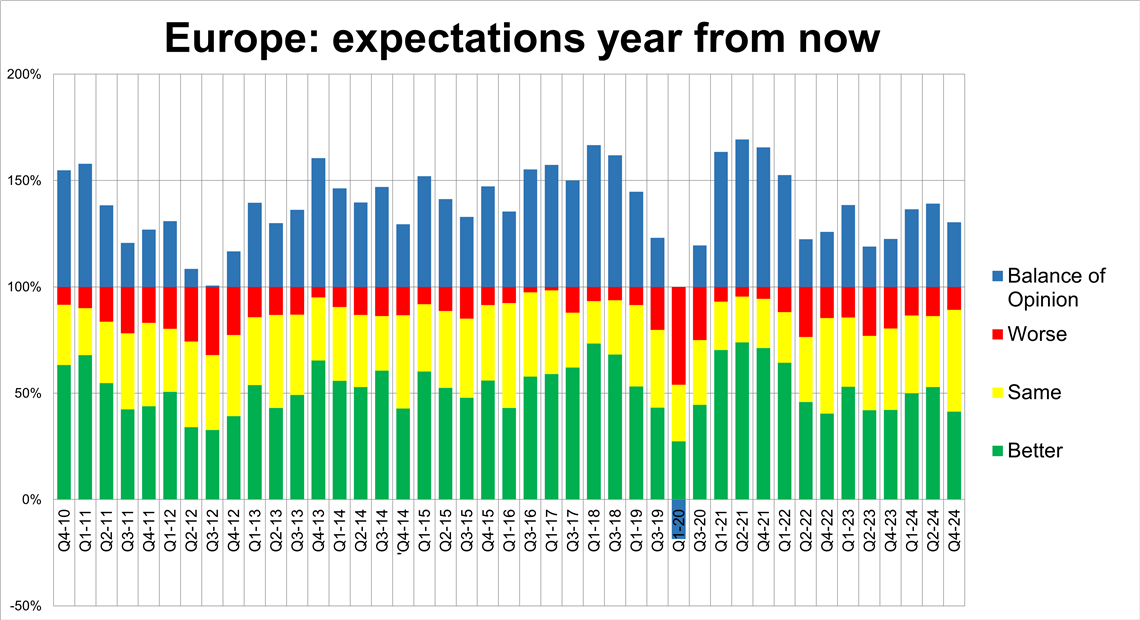

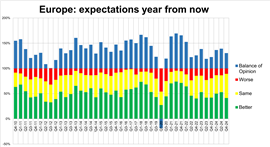

A trend in recent surveys has been one in which responses reveal an industry looking to the future for some form of positivity, and that is what we find here.

In the ‘expectations for a year from now’ metric, 41% said they expect conditions to be better in a year, 48% said they expect no change and just 11% predicted worse conditions, giving a +30% balance.

CapEx and utilisation

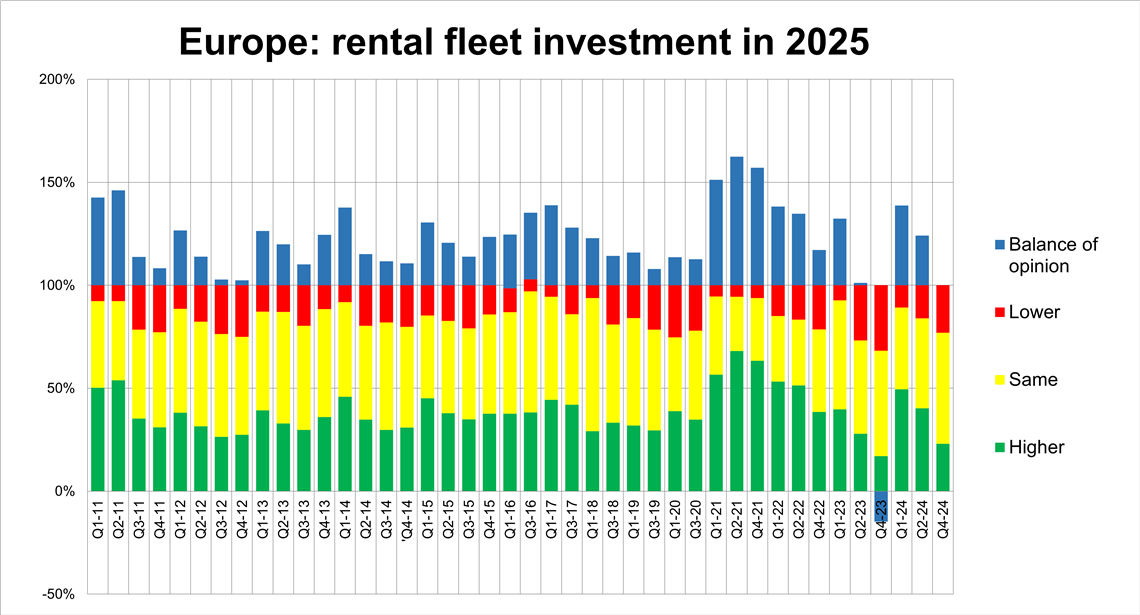

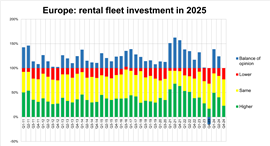

Capital expenditure has been historically high post-pandemic. However, given the current economic climate and weak construction market in some regions it should come as no surprise that companies are expecting to tighten spend this year.

In that respect, there is what can only be described as a significant shift, with just 23% of companies expecting to increase fleet CapEx in 2025, the exact same as those expecting to decrease spending.

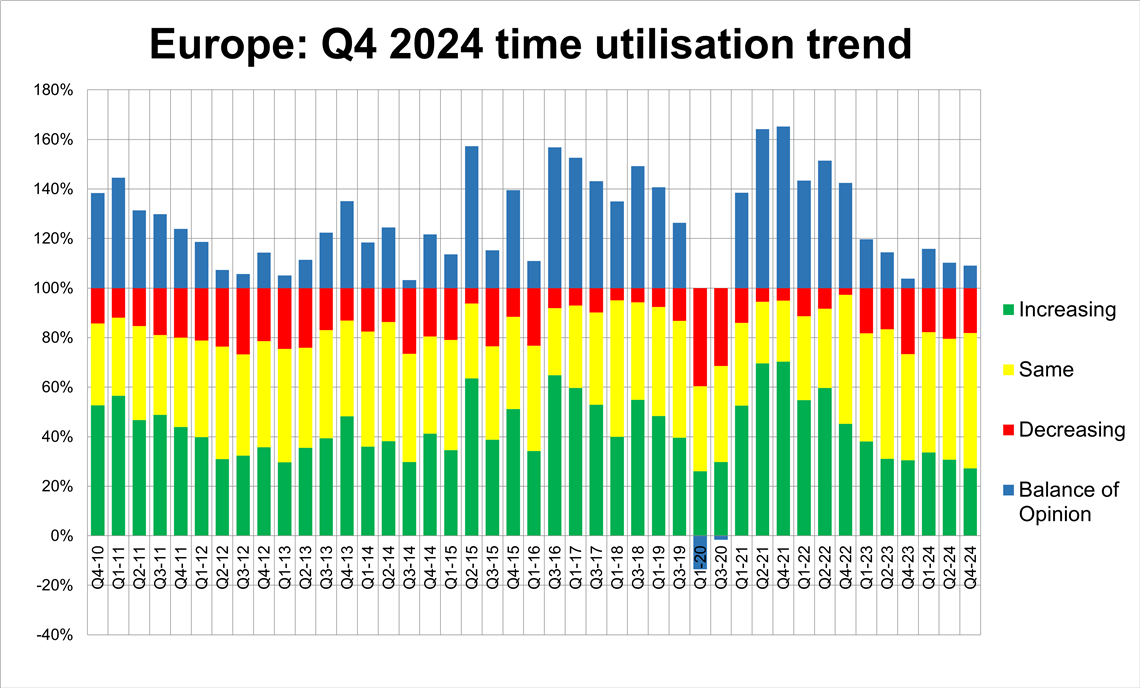

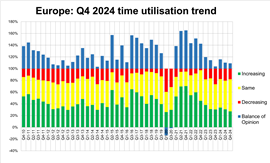

Rental fleet utilisation trend at the end of 2024, from the ERA/IRN RentalTracker survey. (Image: IRN)

Rental fleet utilisation trend at the end of 2024, from the ERA/IRN RentalTracker survey. (Image: IRN)

So, on the face of it the balance of opinion is even, but when comparing the results to the previous survey which was +24%, it is a big drop.

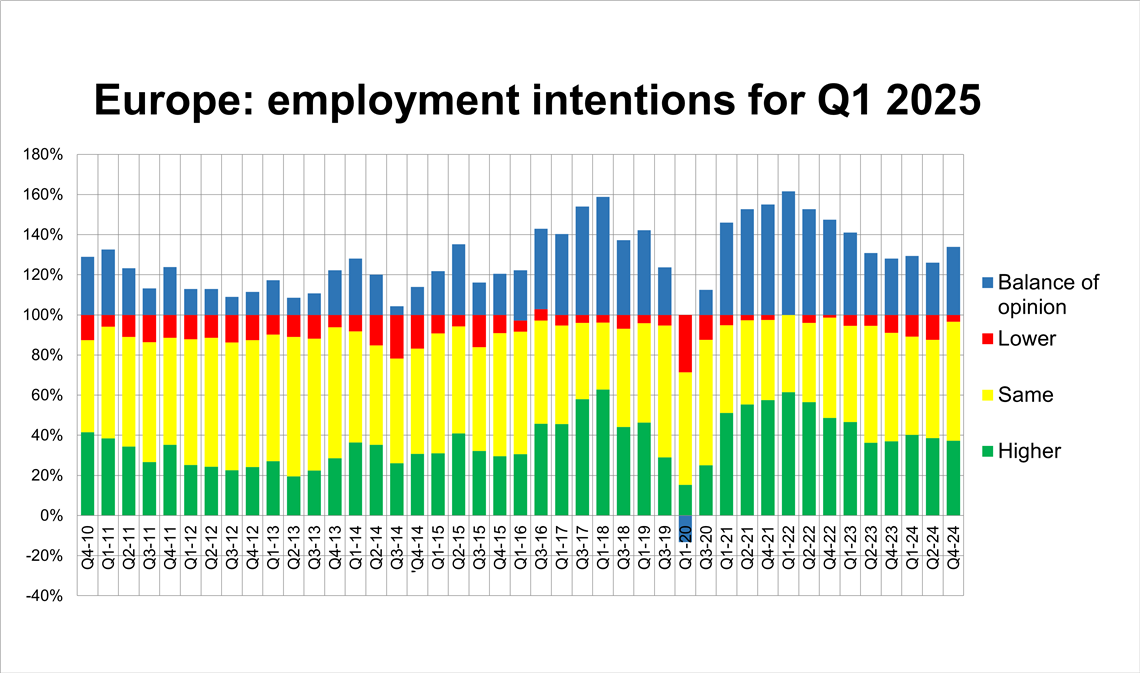

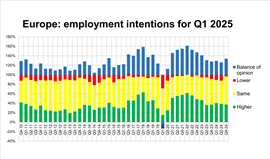

As for employment intentions, 97% of responses said they intend to either recruit more or maintain staff levels in the coming months, with just 3% looking to reduce workforces.

Rental employment trend at the end of 2024, from the ERA/IRN RentalTracker survey. (Image: IRN)

Rental employment trend at the end of 2024, from the ERA/IRN RentalTracker survey. (Image: IRN)

That results in a positive balance of opinion of +33%, but given the skills shortages in Europe and ongoing issues with recruiting and retaining staff, this is probably not a surprise.

How about fleet utilisation levels in the final quarter of 2024? This metric has fluctuated for some time but largely stayed positive since the pandemic.

That is exactly what we find here. The 27% noting increasing utilisation levels versus the 18% reporting a decrease is enough to see a 9% balance of opinion.

Add the 27% to the 55% that said utilisation was stable and the result is even more positive, with more than three quarters seeing at least stability.

Regional focus

Looking at the results from a geographical perspective, the table gives a detailed overview of sentiment across Europe.

Let’s start with the positives. Spain has been one of the strongest markets in terms of RentalTracker sentiment, and this has continued in the Q4 survey, even if the relatively small number of respondents mean that results should be viewed as anecdotal rather than conclusive.

69% of respondents from Spain said they are experiencing improving market conditions (up from 67% in Q2 of 2024), while 36% said they expect conditions to be better in 12 months’ time (up from 18% in Q2 of 2024).

Rental fleet investment trend at the end of 2024, from the ERA/IRN RentalTracker survey. (Image: IRN)

Rental fleet investment trend at the end of 2024, from the ERA/IRN RentalTracker survey. (Image: IRN)

As well as being the only country to be above the European average in each metric, Spain also comes out on top of the countries expecting to employ more (55%), reporting higher fleet utilisation (66%) and anticipating higher investment (66%).

Perhaps the most notable response was the 73% that reported quarter on quarter growth.

On the other side of the coin, not one survey respondent from France said they were experiencing improving current conditions.

Again, a low pool of responses renders this anecdotal, but a pattern is certainly emerging given that French rental and distributors association DLR’s market barometer for Q3 of 2024 revealed that its members “remain concerned about the sector’s future.”

There was a good level of response from Germany, but unfortunately the findings don’t make for great reading.

In fact, Germany comes bottom of all but two metrics, conditions now and business levels for the year ahead (Italy comes bottom here with only 21% of responses expecting business to improve in 12 months’ time).

Just 6% of German respondents said conditions were improving in Q4 last year, the same number that reported quarter on quarter growth.

Perhaps the most eye-catching statistic is that of CapEx, with just 8% of responses from Germany expecting to increase spend (down from 45% last time out) and 46% expecting that to drop in the future, giving a balance of opinion of -38%.

Expectations a year from now, from the ERA/IRN RentalTracker survey. (Image: IRN)

Expectations a year from now, from the ERA/IRN RentalTracker survey. (Image: IRN)

It is a mixed bag from Italy, where there is a drop in sentiment across many metrics, but an increase in positivity in employment intentions (36% will employ more in the first quarter of 2025) and Q4 quarter activity compared to 2023 (29% said Q4 2024 growth vs Q4 2023 had increased).

Looking ahead, 56% of companies in the UK and Ireland expect conditions to be much better this time next year. Sentiment for current conditions in the UK and Ireland is down, with 24% of companies experiencing improving market conditions at the end of Q4 (compared to 50% in Q2 of 2024). However, it is above the European average for CapEx, with 47% expecting to increase fleet spend this year.

Recent RentalTracker surveys pointed towards an industry waiting for better times; the Q4 results suggest that the waiting may go on.

Notes:

The full report, with more data, will be published in the January-February issue of International Rental News.

The survey was conducted in December 2024 and the first two weeks of January 2025, with more than 120 companies in Europe taking part. IRN would like to thank ERA and national rental associations in Europe for their help in distributing the survey.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM