Which are the world’s fastest growing specialized transport companies?

21 November 2024

Every year International Cranes and Specialized Transport compiles the IC Transport 50 list, based on aggregate transport carrying capacities. Some of these 50 companies are expanding their fleets significantly, but who are they and where do they operate?

The identity of the fastest growing transport businesses over the last 12 months tells you a lot about where the action is in the industry, with six companies from the USA – including six of the top eight – two from the Middle East, and one each from Europe and India.

The top 10 growth league is based on the IC Transport 50 list, as measured by the year-on-year increase of the total transport capacity of the companies with the world’s largest fleets of specialized trailers, modular trailers and dollies.

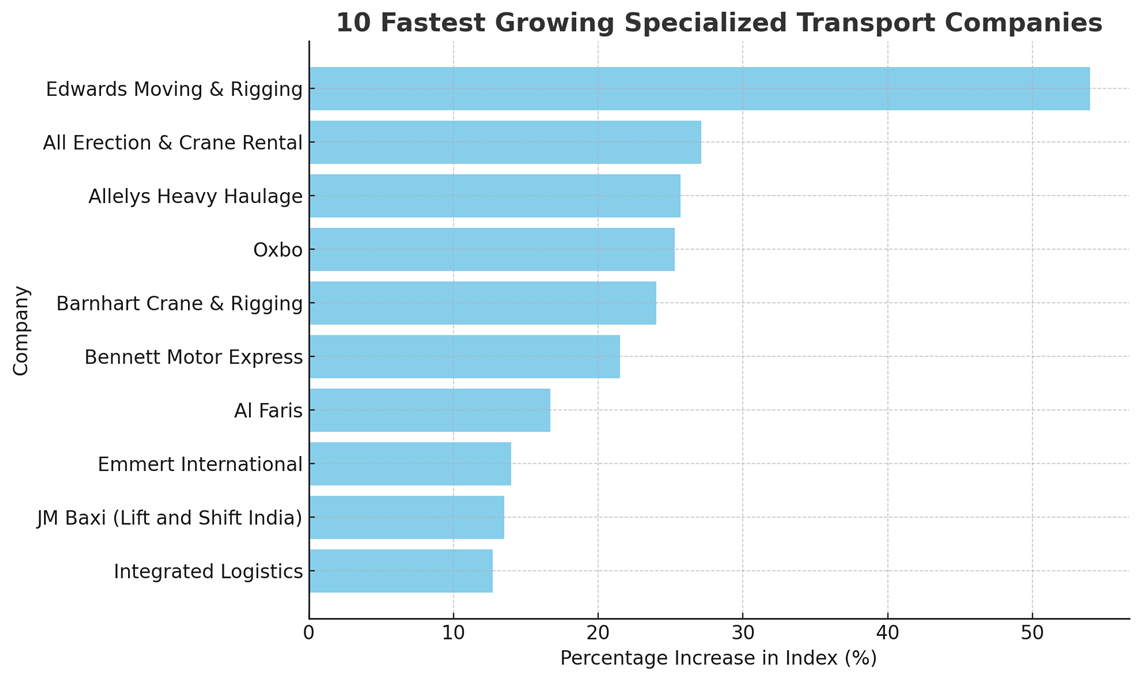

List of the ten fastest growing specialized transport companies between 2023 and 2024. (Image: KHL Group)

List of the ten fastest growing specialized transport companies between 2023 and 2024. (Image: KHL Group)

The dominance of companies from the USA illustrates the relative strength of its economy compared to Europe and the continued investment in sectors, including renewable energy, oil and gas and ‘mega projects’ in general.

It is revealing that there is just one Europe-based company in the fastest growing league – UK business Allelys – reflecting the more sluggish economic environment in the region.

The fastest growing 10 businesses, which reported an average 23 per cent increase in their transport capacities, and the percentage increase in the IC Transport Index for each, are as follows:

1. Edwards Moving & Rigging (USA) +54%

Kentucky-based transport and rigging specialist – and one that does not have a crane rental fleet – active in the US energy, oil and gas, and manufacturing. It has locations in its home State as well as Illinois, Ohio, Florida, South Carolina, Tennessee, Pennsylvania and Indiana.

2. All Erection & Crane Rental (USA) +27%

Part of the privately owned All Family of Companies, All Erection & Crane Rental is one of the biggest crane and specialized transport businesses in the USA. Based in Cleveland, Ohio, it has branches throughout the eastern portion of the USA. The company is constantly renewing its transport fleet, including the recent addition of two Faymonville HighwayMax heavy-haul trailers.

3. Allelys Heavy Haulage (UK) +26%

Fast-growing UK company Allelys – the only European company in the ‘fastest growing’ list – has recently made a “substantial” purchase of new transport equipment, including multiple girder frame trailers, a range of modular axles and various heavy ballast trucks, including UK-designed and built Trojan trucks. Allelys, based south of Birmingham, said it operated the largest fleet of girder frame trailers in the UK. The company also offers crane and heavy lift services.

4. Oxbo (USA) +25%

Based in Scappoose, Oregon, and with further locations in Portland, Oregon and Houston, Texas, Oxbo is very active in infrastructure and energy projects. Recently transported 290 wind turbine components for a wind farm project in Oklahoma.

5. Barnhart Crane & Rigging (USA) +24%

One of the largest crane and specialized transport companies in North America, with more than 60 locations in the USA and Canada. It significantly grew its business in Canada earlier this year with the acquisition of NCSG, and then of Mountain States Crane, a smaller business in New Mexico. Acquisitions has been a theme for Barnhart in the last 18 months, making three purchases in 2023 as well as a South Carolina business at the start of 2024.

6. Bennett Motor Express (USA) +22%

Bennett Motor Express is described as the ‘flagship’ company within the Bennett Family of Companies. Sister businesses include BOSS Heavy Haul and BOSS Crane & Rigging. Based in McDonough, Georgia, its fleet includes flatbed, step deck, heavy haul and super heavy haul equipment, serving customers in government, aerospace, wind energy and shipping. Named the top woman-owned transportation business in the USA this year, for the sixth consecutive time.

7. Al Faris (UAE) +17%

One of the largest crane and specialized transport companies in the Middle east, also running a power rentals business. Active in UAE as well as Saudi Arabia, and has worked in Iraq in recent years.

8. Emmert International (USA) +14%

Oregon-based company founded in 1968 by Terry Emmert. Made a name for itself early on by designing and manufacturing its own heavy haul and rigging equipment. It has four locations throughout the USA and operates in North America, Central America and the Caribbean.

9. JM Baxi (India) +14%

Indian conglomerate active in ports, container depots, logistics and bulk cargo. Has steadily increased its specialized transport fleet over the years and is now ranked at 22 in the IC Transport 50 having been ranked 41 as recently as 2021.

10. Integrated Logistics (Kuwait) +13%

Kuwait-based company active in port logistics, cranes, specialized transport and project services. Also rents power generators and earthmoving equipment. Has offices in Kuwait, Saudi Arabia and Qatar. Transport division includes specialist ‘rig move’ equipment for oil and gas.

Not the biggest companies

One thing that is clear for this list is that it isn’t necessarily the largest companies that are growing the quickest.

Of the ten fastest growing companies, just three are top ten companies in the IC Transport 50 – All Erection, Barnhart and Al Faris – while only five are among the largest 20 companies.

| Rank | Company | Country | % increase in IC Transport 50 Index |

| 1 | Edwards Moving & Rigging | USA | +54.0% |

| 2 | All Erection & Crane Rental | USA | +27.1% |

| 3 | Allelys Heavy Haulage | UK | +25.7% |

| 4 | Oxbo | USA | +25.3% |

| 5 | Barnhart Crane & Rigging | USA | +24.0% |

| 6 | Bennett Motor Express | USA | +21.5% |

| 7 | Al Faris | UAE | +16.7% |

| 8 | Emmert International | USA | +14.0% |

| 9 | JM Baxi | India | +13.5% |

| 10 | Integrated Logistics | Kuwait | +12.7% |

All Erection is the only one of the fastest growing companies that is a top five transport fleet owner, as ranked in the IC Transport 50 list.

The other four – Mammoet, Sarens, Fagioli and Landstar – either saw modest growth or an actual decrease in fleet capacity.

Half of the companies in the fastest growing list are specialist specialized transport businesses, while the other five combine cranes and transport. Two are part of wider conglomerates operating in ports and logistics (JM Baxi in India and Kuwait-based Integrated Logistics).

Key customer sectors

One other aspect of the list is exposure to some key industries, such a renewable energy (wind turbines) and the oil and gas sector.

Middle Eastern economies are still heavily reliant on petrochemicals and oil and gas, although infrastructure projects in Saudi Arabia will soon be rivalling that in terms of activity.

In the USA the incoming president has signalled continued investment and exploitation of oil and gas reserves. Alongside that, there is growing spending on wind farms – a staple for specialized transport companies. The US Department of Energy reported in August 2024 that the USA added 6.5 GW of onshore wind power capacity in 2023, amounting to $10.8 billion of investment. It forecast that annual additions would reach 14.5 to 24.8 GW by 2028, the great majority through land-based wind farms.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM