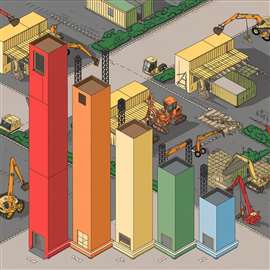

Animation: Post-pandemic rental revenues soar nearly 40%

07 April 2025

As submissions open for IRN’s official list of the top 100 equipment rental firms, Lewis Tyler takes a look at the trends behind the figures.

Revenues for the world’s top ten biggest rental companies have risen by nearly 40% since before the pandemic, driven by a series of aggressive corporate acquisitions and ambitious investments.

Figures from International Rental News’ annual rankings of the equipment rental businesses with the highest revenues shows that total sales for the top ten surged 38% in the five years from 2019, reaching just over €37 billion in 2023.

Using computer animations, IRN has put together a chart to show how the revenues of each of the top ten changed over that time.

Shifting positions

The top two positions have remained stable, with United Rentals and Ashtead Group (owner of Sunbelt Rentals) maintaining their dominance by a considerable margin.

United Rentals, in particular, hit a milestone last year by becoming the first company to surpass the €10 billion revenue mark.

Outside the top two, Herc Rentals has demonstrated significant growth with a 24% revenue increase in 2023, climbing from sixth place in 2020 to third by 2024.

This rise is a result of its strategic expansion efforts such as its high CapEx and M&A activity.

It will likely accelerate further with its planned $5.3 billion acquisition of H&E Rentals and $260 million deal for Otay Mesa Sales in July 2024.

Image created using AI via Ideogram

Image created using AI via Ideogram

Loxam has remained a steady force in the market, consistently ranking among the top five. As the largest rental company in Europe, Loxam has been highly active in mergers and acquisitions, broadening its presence beyond the continent.

The company has also made strides in sustainability, investing in low-emission equipment and digital solutions to enhance fleet efficiency.

Aggreko has also focused heavily on transitioning toward greener energy solutions, including battery storage and hybrid power systems, in response to increasing regulatory and customer demands for sustainable energy solutions.

Meanwhile, Boels has strengthened its footprint in Europe through acquisitions, including its takeover of Cramo in 2020, which significantly expanded its market share.

The company has also emphasised digitalization, implementing fleet management tools to enhance operational efficiency.

Emerging rental companies

While the IRN100 highlights consolidation among the biggest rental firms, it also reveals intriguing new entries.

For instance, WillScot Mobile Mini and Modulaire have secured spots in the top 10. WillScot Mobile Mini reached seventh place by 2022 and has maintained its position, while Modulaire climbed to eighth during the same period.

Its growth reflects the rising demand for modular and portable storage solutions, with companies like Alayan (formerly CGTE) and Nixon Hire making substantial investments in the sector.

One of the more interesting stories is that of tech specialist EquipmentShare. Just five years ago, it was not even in the top 100 (having been founded in 2015). Since then, it has grown exponentially, breaking into the top 10 for the first time last year.

Given its rapid expansion—including a predicted 75% revenue increase in 2023 compared to 2022—it wouldn’t be surprising to see it climb even higher in the coming years.

Regional dynamics

A recurring theme in the IRN100 is the dominance of North American companies, although to a lesser extent than some might expect.

In 2019, only three North American companies were in the top 10: United Rentals, Herc Rentals, and WillScot Mobile Mini. By 2024, the addition of EquipmentShare has increased North America’s share to 40% of the top 10.

In 2019, Europe had five companies in the top 10 (Boels, Ashtead, Loxam, Modulaire, and Aggreko), while Asia was represented by Japan-based Nishio Rent All and Aktio Holdings Corp.

Aktio Holdings initially ranked third in 2020 but has since declined to sixth place by 2024, likely due to Japan’s weaker market conditions and growing competitive pressures in the Asian region. Similarly, Nishio Rent All has slipped out of the top 10, albeit not significantly.

Meanwhile, Loxam and Aggreko have maintained consistent positions within the top five, demonstrating resilience in the European market. Loxam, in particular, has expanded beyond Europe through mergers and acquisitions.

An interesting detail not captured in the rankings is that Modulaire was known as Algeco Scotsman in 2019, further illustrating the shifting landscape of the rental industry.

CapEx figures

Capital expenditure (CapEx) has remained historically high for the top rental companies. The table below compares CapEx figures for the top 10 in 2019 and 2023:

Six of the top 10 (Ashtead, United Rentals, Loxam, Herc, Aggreko, and WillScot) were among the top 25 CapEx investors in both years.

However, not all companies disclose their CapEx figures. For instance, while Boels reported a €543 million CapEx investment in 2023, no data was available for 2019.

Similarly, Aktio and EquipmentShare did not provide CapEx figures for either year. So, while we can’t strictly say they were among the highest spenders, we can’t rule that out either.

A key driver of this sustained investment is the growing focus on specialty rentals. United Rentals and Ashtead have both expanded significantly into specialty markets, such as climate control, power solutions, and trench safety.

Notable new entries into the top 100 since 2019

- EquipmentShare

- Armac

- REIC

- AJ Networks

- Group Monnoyeur Rental

- Colle Rental & Sales

Notable drop outs from the top 100 since 2019

-

GSV Materieludlejning (acquired by Kiloutou)

-

Cramo (acquired by Boels Rental)

-

Ahern (acquired by United Rentals)

-

Ramirent (acquired by Loxam)

-

National Pump and Energy (Acquired by Atlas Copco)

Ashtead’s Sunbelt Rentals division has actively acquired specialty rental firms to strengthen its presence in high-margin sectors like pump and power rental. Likewise, United Rentals has invested heavily in expanding its speciality division, particularly in infrastructure-related rental solutions.

Herc Rentals has also followed this trend, broadening its speciality fleet in areas such as climate control and remediation equipment.

Similarly, Aggreko, a provider of temporary power and temperature control solutions, has maintained strong investment levels to adapt to growing demand for sustainable and energy-efficient rental solutions.

IRN100 2025 open for submissions

International Rental News is inviting companies to submit data for this year’s IRN100, the list of the largest 100 rental companies in the world based on 2024 revenues, to be published in the June issue.

Deadline for submissions for the IRN100 is Friday, 2 May, 2025.

Companies will be ranked on rental-related revenues, including all revenues related to rental operations, including sales of used fleet, but excluding sales of new equipment where these are very significant. There is no cost for inclusion in the survey.

The following survey data is required:

Company name

Annual rental revenues (2024)

Gross capital expenditure on fleet (2024)

Type of rental

Number of rental locations

Number of employees

Head office location (city, country)

Countries of operation

Name of managing director/CEO

Contact details (telephone, website)

A downloadable questionnaire can be found below, alongside a complimentary version of the IRN100 2024 Extended.

Supporting documents

Click links below to download and view individual files.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM