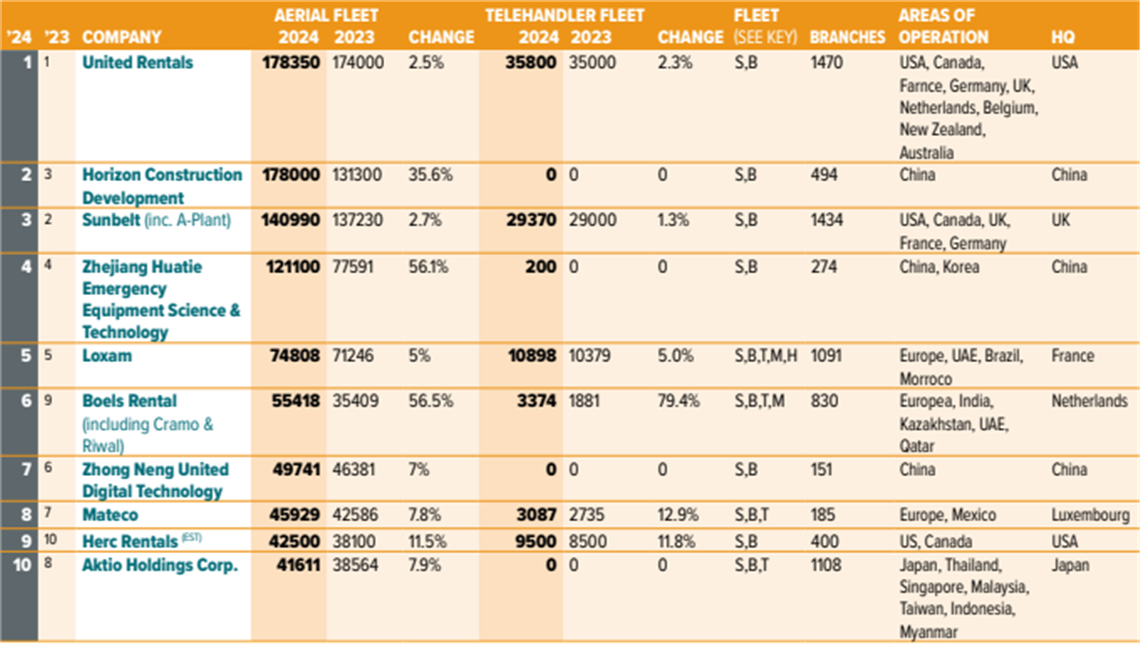

Top 10 access equipment rental fleets in the world

18 September 2024

The latest edition of the access50 demonstrates rental’s resilience in the face of adversity, with the sector still reporting growth amid tough conditions across Europe and China.

The Access50 Extended brings you an indepth report on AI’s annual listing of the world’s largest access equipment rental companies through a range of breakout charts, graphs and analysis.

The top spot in the annual ranking from Access International has again been taken by United Rentals, but only just, as Chinese rental company Horizon Construction Development moves into a very close second position.

The latest edition of the access50 demonstrates rental’s resilience in the face of adversity, with the sector still reporting growth amid tough conditions across Europe and China.

The latest edition of the access50 demonstrates rental’s resilience in the face of adversity, with the sector still reporting growth amid tough conditions across Europe and China.

Up from third place last year, Horizon saw a 35.6% rise in its fleet size this year over 2023, bringing it up to an impressive 178,000 units. It marks the first time a rental company from China has taken second position, which up until now has been firmly held by Sunbelt Rentals.

The China equipment market has seen outstanding growth since 2017, despite a recent downturn which threatens to continue over the next couple of years.

There are now three entries from China-based outfits in the top 10 of the access50, compared to five years ago, when there were none across the entire listing.

Reshuffling the ranking

Overall, the top 10 of the world’s largest access equipment fleets remains the same as last year in terms of the companies that are included in it. However, there has been a move around in their positions.

Apart from the second and third place swap between Sunbelt Rentals and Horizon Construction Development, Boels has jumped from ninth in 2023’s access50 listing to sixth this year. The company displaces China’s Zhong Neng United, from the sixth spot to seventh.

These jumps have also led to a reshuffle in the last three spaces in the top 10, between Mateco, Herc Rentals and Aktio.

United Rentals remains strong and has been focusing on the acquisition of non-access speciality rental companies this year, outside of the construction space. Hence the company’s MEWP fleet size has not grown significantly year-on-year in the table.

At the end of August, United continued its move into the speciality sphere, and its expansion outside North America, with the acquisition of shoring propping equipment renter Shore Hire in Australia. It will operate alongside its other two Australian investments: Orange Hire, bought last year, and Royal Wolf. It also follows the buyout of US-based temporary roadway rental business Yak Access, Yak Mat and New South Access & Environmental Solutions, in March, for $1.1 billion.

Following is how the top companies rank in 2024:

10. Aktio Holdings Corp.

Based in Japan, with operations also in Thailand, Singapore, Malaysia, Taiwan, Indonesia and Myanmar, Aktio dropped from #8 last year to #10, with a current fleet of 41,611 aerial units.

9. Herc Rentals

One of only two US-based companies in the top 10, Herc Rentals rose to #9 from #10 last year and has an aerial fleet of 42,500 machines.

8. Mateco

This renter from Luxembourg dropped one position in the ranking, from #7 in 2023 to #8 this year. The company owns 45,929 aerial units.

7. Zhong Neng United Digital Technology

One of three China-based companies on the list, Zhong Neng United Digital Technology owns 49,741 aerial units, dropping to #7 from its #6 position last year.

6. Boels Rental (including Cramo & Riwal)

Based in the Netherlands, Boels Rental took a big leap this last year, jumping from #9 on the list to #6. This is due, in part, to its acquisition of access specialist Riwal earlier this year. It has a fleet of 55,418 aerial machines.

5. Loxam

France-based Loxam was consistent, holding its #5 position year over year with a fleet of 74,808 aerial units.

4. Zhejiang Huatie Emergency Equipment Science & Technology

Also staying in the same place on the list at #4 is China-based Zhejiang Huatie Emergency Equipment Science & Technology. It has 12,1100 aerial machines in fleet.

3. Sunbelt Rentals (inc. A-Plant)

Dropping one spot, from #2 to #3, is Sunbelt Rentals, serving the US, Canada, UK, France and Germany as part of the UK-based Ashtead Group. The company owns 140,990 aerial units.

2. Horizon Construction Development

With a formidable fleet of 178,000 aerial machines, Horizon Construction Development takes its place at #2 on the list after coming in at #3 last year. As noted above, this is the first time a China-based rental firm has been in the #2 position in the history of the access50 ranking.

1. United Rentals

Staying at #1 is US-based United Rentals, the largest rental company in the world with an aerial fleet of 178350 units.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM