Optimism and apprehension: How US construction firms view 2025

09 January 2025

The US construction market has been a model of resilience compared to global peers in recent years, and US contractors’ confidence coming into 2025 remains high. But uncertainty regarding trade and immigration policies supported by the incoming Trump administration have some worrying about labour and a pricing whiplash.

President Donald Trump, flanked by his son Baron Trump, his wife Melania Trump and JD Vance, waves to the crowd after speaking during election night last November. (Image: Matias J. Ocner/Miami Herald/TNS/ABACAPRESS.COM)

President Donald Trump, flanked by his son Baron Trump, his wife Melania Trump and JD Vance, waves to the crowd after speaking during election night last November. (Image: Matias J. Ocner/Miami Herald/TNS/ABACAPRESS.COM)

UK-based software firm Sage Group and the Associated General Contractors of America (AGC), a trade association for general contractors in the US with more than 22,000 members, released their annual outlook report (“A Year in the Balance: The 2025 Construction Hiring and Business Outlook”) alongside a live webinar on 8 January.

The discussion revealed – despite general optimism regarding an improved regulatory environment – that the industry has significant concerns on some of President-elect Donald Trump’s proposed policies.

The combination of optimism and targeted concern is making for an anxious start to the year, as Trump is set to take over on 20 January.

Here’s a look at what AGC leadership and contractors said while looking ahead at what could be a two-sided 2025.

AGC says Trump’s tariff proposals could harm construction and economy

One of the more troubling outlooks for US construction in 2025 is the potential for an escalating trade war between North American neighbours Canada and Mexico.

As of last year, the two countries that the US buys most goods from are Mexico and Canada, respectively. China once held the top spot but dropped to third in 2024. Trump administration tariffs on Chinese goods from his first term led many US businesses to expand manufacturing and supply chain footprints in Mexico and Canada.

Ken Simonson, chief economist for AGC, said plainly, “I think nearly all economists, at least those who aren’t joining [the Trump] administration, would say that Trump tariffs – particularly ones as steep as 25% on our biggest trading partners – are very damaging to our own economy.”

Simonson said enacting such tariffs will assuredly drive-up material prices on imported construction-specific items, but also is likely to increase costs on all imported goods. He posited domestic suppliers will also increase their prices, as a result.

Flags of North America: from left, Canada, the US and Mexico. (Image: Adobe Stock)

Flags of North America: from left, Canada, the US and Mexico. (Image: Adobe Stock)

“In addition, I think the biggest damage from tariffs is the follow-on effects that other countries retaliate,” he added. “That takes away market share from certain US firms [and] lowers our competitiveness.

“So, I’m quite worried about both specific effects on construction costs and, frankly, disrupting supply chains, but – more broadly – the damage to the overall economy.”

Rex Kirby, president of Verdex Construction in Florida, offered an optimistic view on the proposed tariffs.

“This is a ‘hope’ versus an equipped knowledge, but I’m hoping that some of [the tariff proposals] turns out to be more of a negotiating tactic than truly an occurrence,” he said, noting that during Trump’s first term “he was able to get some things done by just putting the… threat out there and getting some movement and then not actually following through with the actual act.”

Andy Heitmann, vice president and operations manger at Turner Construction, noted his firm and peers are adept at navigating challenges like increased imported materials prices, but he also recognised, in the short term, heavy tariffs with Canada and Mexico could lead to delayed or stalled projects.

“Construction companies, designers do get creative and try to look at different avenues… but there is no doubt that [tariffs will] have an impact on the cost of construction,” he said. “If the cost… gets to a point that building something doesn’t pencil from an economic standpoint, it certainly can shut a job [down], or we might have some work not even start.”

Construction supports keeping its legal immigrant workforce

Another worry for 2025 is Trump’s hardline stance on undocumented immigrants. The president-elect has vowed to begin mass deportations of immigrants who entered or live in the country unlawfully.

For construction, this could cause significant pain in an already limited skilled labour market: statistical analysis shows somewhere between 15% and 23% of the US construction workforce is comprised of undocumented immigrants.

Even though Verdex workers have visas in place to work in the US legally, Kirby said there’s nonetheless a sense of “fear” among some workers in Florida at the prospect of mass deportations.

Rex Kirby (Image courtesy Verdex Construction)

Rex Kirby (Image courtesy Verdex Construction)

“Because we do have a largely immigrant workforce,” he said. “They’ll ask our teams in the field frequently, ‘What’s going to happen here? [Are] they going to try and send me home?’”

Kirby said bolstering the ways immigrants can obtain and maintain legal work visas would be prudent.

Simonson remarked that AGC is actively lobbying the incoming administration to develop short- and long-term solutions regarding immigration and labour.

“In the short term, we are urging the new administration to work with Congress to establish new programmes for temporary work vias that are dedicated to the construction industry,” he said. “This will allow firms a way to provide lawful workers so they can keep pace with important economic development projects like improving infrastructure and building new manufacturing and semiconductor facilities.”

Still a positive outlook for US construction in 2025

While the uncertainty of trade and immigration policy has some contractors feeling uneasy about prices and labour, survey results from AGC’s outlook report – and reflections from the contractors contributing to the webinar – still showed plenty of positives that can make for a productive 2025.

“Firms expect regulatory relief will help drive demand, particularly for all manner of public sector projects,” Simonson said.

Specifically, Simonson said AGC supports reducing limits and regulation on large federal construction projects.

“[Trump] should revoke President Biden’s executive order imposing project labor agreements for any federal construction project worth US$35 million or more,” Simonson said. “The measure essentially excludes two-thirds of the construction workforce from participating in federal projects, severely undermining the nation’s capacity to build.

“At the same time, President Trump should remove many of the bureaucratic obstacles his predecessor put in place with the new Buy America requirements. While we support efforts to reestablish a domestic supply chain for construction materials, the Biden administration’s approach makes it virtually impossible to move forward with projects when no domestic component is available.”

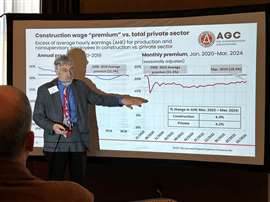

Associated General Contractors of America (AGC) chief economist Ken Simonson presents to the AGC Greater Milwaukee chapter in Wisconsin, US, on 24 April, 2024. (Image: Mitchell Keller)

Associated General Contractors of America (AGC) chief economist Ken Simonson presents to the AGC Greater Milwaukee chapter in Wisconsin, US, on 24 April, 2024. (Image: Mitchell Keller)

Brian Turmail, vice president of public affairs and workforce for AGC, told Construction Briefing, “We’re looking for the [future] president to enact some of the already-authorised-by-Congress reforms to the federal permitting process that would keep the same high standards in terms of meeting environmental thresholds for approval of projects, but accelerate how long it takes federal agencies to conduct those reviews.”

Simonson also expected Trump’s administration to support streamlined permitting processes and expanded access to material waivers (for products unavailable or too expensive to source domestically) for construction firms working federal schemes.

Simonson concluded, “The good news is the incoming president has the authority he needs to rapidly accelerate federal reviews without diminishing the criteria used to get a ‘go’ or ‘no go’ with a project. If President Trump moves quickly to streamline the permitting process, many delayed projects should see a rapid start to construction.

“The bottom line is 2025 should be a good year for the commercial construction industry, especially if the Trump administration is willing to work with us to find a way to address workforce shortages, avoid materials price inflation, remove limits on who can work on federal projects, and streamline the permitting project process.”

Ultimately, all eyes in construction will be on Trump come inauguration day, 20 January, as it is expected that a flurry of executive orders will be signed that afternoon. Should Trump follow through on his hardline tariff and immigration policies, the start of the year could be more of a Mr Hyde than a Dr Jekyll.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM