Data centre construction is hitting new heights but capacity fears loom

27 August 2024

A render of a data centre created by artificial intelligence (AI). (Image: Adobe Stock)

A render of a data centre created by artificial intelligence (AI). (Image: Adobe Stock)

Data centre builds continue to be a red-hot sub-sector of the construction industry although the explosion in activity could ultimately prove a limiting factor.

That’s according to a raft of new data revealing activity levels in the sector to have emerged this summer.

Most recently, we learned that data centre construction in the US – one of the regions of the world with the largest number of data centres alongside China – has hit a record high.

A report released last week by real estate company CBRE found that the total capacity of data centre projects currently under construction in US primary markets amounted to nearly 3.9 gigawatts in the first half of 2024.

That represents a 70% increase in construction activity on a year earlier, and a significant rise since 2020.

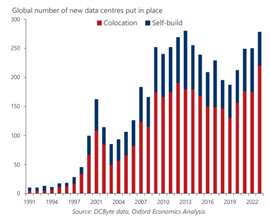

And yet a research briefing by Oxford Economics published earlier this summer declared that even though data centre construction has surged in the past three decades it is “only getting started”.

It said there were “no signs” that data centre construction will abate in the coming years despite more than 250 being built around the world in 2023 (see chart below).

The rapid increase in data centre construction is being driven by massive demand for data storage, process and analysis required for cloud computing and the nascent artificial intelligence (AI) sector.

Growth has been further spurred by certain regions, including several US states and localities offering economic incentives like tax breaks and grants to attract data centre prospects to make themselves more attractive locations for data centre development.

Oxford Economics found that the US is likely to be one of the main beneficiaries of the data centre construction boom thanks to its high usage of digital services across a range of different industries.

Despite economic headwinds in Europe, data centre construction growth is expected to remain there too. A report by Savills published in May this year said that it expected total European data centre power capacity to rise by 13,100 megawatts by 2027, reflecting a 27% increase.

In the Middle East, a report by Turner & Townsend in February this year put the total value of active data centre projects in the United Arab Emirates (UAE), one of the fastest-growing data centre industries in the region, at US$1.2 billion and the future project pipeline at $433 million. The Kingdom of Saudi Arabia is another sizeable market in the Middle East with over 40 projects under construction at the time the report was published.

Meanwhile, Malaysia has emerged as the fastest-growing data centre market in Southeast Asia, attracting billions of dollars worth of investment from tech firms like Google, Nvidia and Microsoft from more or less a standing start, according to DC Byte’s 2024 Global Data Centre Index.

Such has been the growth centred around the city of Johor Bahru in Malaysia, that if all the planned data centre capacity were to come online across Asia, only Japan and India would be ahead of it, according to DC Byte.

Certain regions of Latin America are also seeing rapid growth, with the region’s data centre inventory increasing 15% year on year in Q1 2024 to 650.2 MW, according to CBRE. The city of São Paulo in Brazil currently accounts for 67% of the top four countries’ total inventory in the region but inventory grew most in Bogotá in Colombia.

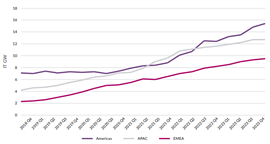

Global pipeline of under-construction and committed data centre developments by region (Source: DC Byte)

Global pipeline of under-construction and committed data centre developments by region (Source: DC Byte)

Multi-billion-dollar investments

Data is helping maximise crane efficiency on a data centre construction project. Photo: Wolffkran

Tech giant Microsoft has announced a series of major investments in data centres, including $3.3 billion for a facility in Racine County, Wisconsin in May this year. In the same month, it also announced plans to invest $4.3 billion in cloud and AI infrastructure in France, with expansions at existing sites in Paris and Marseilles, as well as a new campus in the east of the country.

Amazon reportedly plans to invest over $100 billion over the next decade on data centres, with a significant portion of this dedicated to cloud computing and AI infrastructure. In April this year, it announced plans for an $11 billion investment via Amazon Web Services in new data centres in St. Joseph County, Indiana, USA. The following month, it revealed a $17 billion investment in Spain’s Aragon region, and $9 billion in cloud computing infrastructure in Singapore.

And in June this year, China’s ByteDance, which owns TikTok, unveiled plans to build an artificial intelligence hub in Malaysia at a cost of around $2.1 billion.

Limits on further growth

But the rapid pace of construction in the sector could be tempered by a shortage in the power required to run data centres.

As Charlie Bater, director of data centres at UK-based construction specialist Black & White Engineering, told Construction Briefing earlier this year, “What we’re finding is that basically any data centre development at the moment is power restricted.

“If you don’t have a big power connection you don’t have a project. In the core busy markets, power is becoming more and more finite. Developers are reaching out to tier two or tier three markets – so from Frankfurt, look to Berlin, Berlin to Munich – just because we week running out of power in regions.”

CBRE’s recent report on the US data centre market made a similar point. “A shortage of available power and longer lead times for electrical infrastructure continued to delay construction completions,” it noted.

“Power availability remained the top consideration in data centre site selection,” it added.

In fact, its Global Data Centre Trends 2024 report highlighted construction delays and power challenges as issues facing markets the world over.

It added, “High-performance computing will require rapid innovation in data centre design and technology to manage rising power density needs.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM