Access50 Extended - access rental toughs it out

07 October 2024

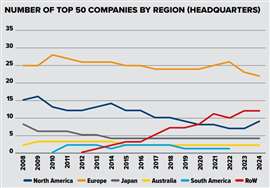

The 2024 access50 extended demonstrates rental’s resilience in the face of adversity, with the sector still reporting growth amid tough conditions across Europe and China, with downward forecasts in North America.

Based on the 2024 edition of Access International’s unique access50 listing of the world’s largest access equipment and telehandler rental companies, ranked by fleet size, this free to view 14-page Extended version provides in-depth analysis of the industry.

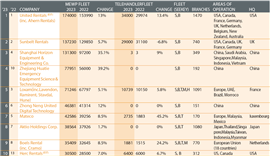

The top spot on the listing has again been taken by United Rentals, but only just, as Chinese rental company Horizon Construction Development moves into a very close second position.

Up from third place last year, Horizon saw a 35.6% rise in its fleet size this year over 2023, bringing it up to an impressive 178,000 units.

It marks the first time a rental company from China has taken second position, which up until now has been firmly held by Sunbelt Rentals.

Indeed, the Access50 listings of recent years have also been remarkable for the growth seen by the Chinese rental companies.

|

About the ACCESS50 Extended The Access50 Extended 2024 offers a comprehensive insight into today’s access rental market, and is available free online. Based on the 2024 edition of Access International’s unique access50 listing of the world’s largest access equipment and telehandler rental companies, this free to view 14-page Extended version provides in-depth analysis of the industry. Through a range of breakout charts, graphs and discussion points, the free-to-view access50 Extended highlights the challenges, trends and opportunities across the international access rental sector. For the full version of the access50 Extended visit www.accessbriefing.com and search access50. |

They have reported more than 200% fleet increases on some occasions. While this exceptional growth has slowed, we are still seeing rises of more than 50%, as evident with Zhejiang Huatie’s 56% increase on last year’s fleet to retain fourth position with 121,000 units.

The total number of MEWPs in Chinese rental companies’ fleets in the top 25, this year totals 372,271. That represents a 26% rise on last year’s top 25 total. (Adding the fleet of new entry Liugong Equipment Rentals, in 29th, the total in the top 50 comes to 379,595 units).

While this growth is impressive, there has been an undoubted slowdown in the country’s access sector over the last 12 months. Less than two years ago the overall access sector growth rate stood at around 40% or more per year. It is forecasted that there will be no growth or negative growth for the next two years, leading up to 2027.

Fluctuating growth

In response to the inevitable ups and downs, there has been a notable shift by major US rental companies to lessen their reliance on the construction industry and its cyclical nature. Recent acquisitions have seen these companies investing in speciality rental companies that are not directly related to the construction market.

Food for thought is United Rentals’ gradual, yet continuing move into Europe with the opening of a depot in Scotland this summer – the company’s fourth in the UK. In May United announced it had acquired EQUIN, headquartered in the Netherlands, this time with a more typical equipment range of generators, compressors and lighting towers and a range of depots across the Benelux region. As a side note EQIN had previously entered Germany with its buyout of ToolsRent24.

Top 10

The top 10 of this year’s access50 remains the same as last year in terms of the companies that are included in it. However, there has been a move around in their positions.

Table showing the biggest companies in the world in 2023, according to the size of their access rental fleet.

Table showing the biggest companies in the world in 2023, according to the size of their access rental fleet.

Apart from the second and third place swap between Sunbelt Rentals and Horizon Construction Development, Boels has jumped from ninth in 2023’s access50 listing to sixth this year. The company displaces China’s Zhong Neng United, from the sixth spot to seventh.

Boels’ move up the table reflects some striking developments in the region, including major acquisitions from international rental companies based there, such as Boels Rentals’ buyout of specialist access rental giant Riwal.

The deal makes a real dent in the European access specialist sector and was partly the result of toughening conditions in the market, with equipment prices on the up and rental rates reducing, combined with difficult access to finance.

These jumps have also led to a reshuffle in the last three spaces in the top 10, between mateco, Herc Rentals and Aktio.

As mentioned, United Rentals remains strong and has been focusing on the acquisition of non-access speciality rental companies this year outside of the construction space. Hence the company’s MEWP fleet size has not grown significantly year-on-year in the table.

Top 20

Japanese companies remain steady in the top half of the list, with the continuing presence of three of the big four rental companies in the country Aktio and Nikken Corporation, both in the top 10, while Nishio Rent All is in 13th and Kanamoto just falls short of the top 20, in 21st position this year, from 20th last year. They have all seen stability and growth over the last year, and are looking to expand their horizons further outside of the home market.

Access50 2024 regional graph.

Access50 2024 regional graph.

For example, Kanamoto is already active in Australia, China, Indonesia, Thailand, Vietnam, Philippines and Malaysia and is now looking to expand into the US. Earlier this year Tetsuo Kanamoto, president of Kanamoto, said the company aims to be one of the top five rental companies in the world.

Looking back to Europe, an interesting pair of companies in the top 20 are System Lift and Partnerlift, which between them bring much of Germany’s fragmented rental market together under a cooperative arrangement. The two organisations also cover the other German speaking nations Austria and Switzerland.

There is a history of small, local family-owned companies in Germany, many of which have chosen to join System Lift or Partnerlift, which offer central equipment purchasing, operator training and legal representation, among other services.

With up to 200 members between the two of them, this combined presence allows them a dominant positions in the access50 – in 16th and 17th place.

They continue to expand, even though their scope is limited to the German speaking nations. In 2023, System Lift recorded an increase in rental sales of 9%, compared to the previous year, closing the financial year with a new record rental turnover of €300.7 million.

Top 50

The rest of the listing is full of fascinating companies.

One of those is Brazil-based Mills, which is in 22nd place and has also been growing strongly through acquisition. In Brazil, Mills, the country’s largest rental company, has taken the opposite path to United and Sunbelt by being a specialist access company that has expanded into a generalist.

Mills saw a small reduction in its MEWP fleet this year, down 3.6% at 10,441 units, compared to 2023. But for the 2024 financial year it reported a 25% increase in revenues.

The company said the rise was partly down to its strategy to invest in its heavy rental fleet, including earthmoving, with Mills quadrupling its fleet size in the segment in 2023. It follows the acquisition of earthmoving rental company Triengel Locações e Serviços (Triengel) in 2022.

Sergio Kariya, CEO of Mills, said, “We proved the thesis of investing in the heavy rental market, bringing greater diversification, cash flow predictability and a new avenue of growth for the company.”

Others in the Access50 include South Korea-based Korea Rental Corp and Singaporean company Aver Asia, which both are the largest companies in their respective countries.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM