The highs and lows of access rental and manufacturing in China

14 October 2024

The access sector in China is in a transitional stage as it faces a highly competitive market, over production and an immature rental model that hasn’t kept pace with the incredible growth seen in the country since 2017. AI speaks with the heads of Zoomlion and LiuGong’s access divisions as they take on the challenges both at home and in the export market.

The main issue with the Chinese access equipment market is not just the large volume of MEWPs in the country, more so that it has risen too quickly, says Ren Huili, General Manager of Zoomlion Intelligent Access Machinery.

Ren Huili, General Manager of Zoomlion Intelligent Access Machinery. (Photo: Zoomlion).

Ren Huili, General Manager of Zoomlion Intelligent Access Machinery. (Photo: Zoomlion).

At around 680,000 units, China’s MEWP population is heading towards the size of the US, yet it has got to that point in less than 10 years.

Just over a year ago, the sector’s growth was estimated at 40% or more per annum, now the situation has reversed. From January to August the MEWP market dropped by 55%.

“My personal belief is that there is now a bottleneck in the China market. For next year, I cannot say for sure, there may be just a slight decrease, but it will decrease and in 2027 it will hit the bottom, then we will see change.”

Post 2027 the market will become more stable, “There will not be the big increases like in the last few years - that was not normal.

“In the future, growth will be steadier and companies will start to set up offices in overseas markets. And one day in China the rental fleet will be larger than the one in US but that will happen gradually.”

The sudden and exponential growth has meant that manufacturers and rental companies have not had enough time to develop healthy operations and rental models.

To get there companies must adapt in three key areas: operation, service and digitalization.

Cash concerns

Another major issue is cash flow. Many rental companies simply cannot afford to buy the machines they are operating. “Rental rates keep dropping and some rental companies are facing problems with payments, especially for those who have just entered the market.

“They do not have a strong financial background, so it makes the situation even worse. Then the payments they receive from their customers can not cover their costs. They face payment collection challenges.”

It’s a unique situation in the Chinese market that utilization remains high while market price has hit rock bottom.

“The equipment utilization rate can reach up to 70-90% because there is demand in the market,”

“We have to let the Chinese MEWPs rental industry go through its first cycle before it becomes mature in terms of capital and financial planning.”

It is clear that some companies will go bankrupt and those that survive long term will have the correct processes in place.

The boom line at Zoomlion’s access equipment factory in China. (Photo: Zoomlion).

The boom line at Zoomlion’s access equipment factory in China. (Photo: Zoomlion).

“I cannot predict with certainty who will survive. Some large companies can, and some small companies can as well. Some companies may not be big, but they work well in their local area with a good customer focus and manage their fleet effectively.”

Also, “If you talk about who will meet challenges in the future, first are the companies that have a large quantity of diesel-powered equipment, as there is not much of a market for that anymore.

“Secondly, as mentioned, some companies have increased their fleets dramatically – they have bought a huge amount of equipment and rental rates keep dropping.”

In the future Chinese rental companies may operate differently to the large companies in Europe and North America.

“Generally speaking, China will see the emergence of generalist rental companies like those in the US, but the difference will be that the Chinese rental companies will have a kind of alliance with manufacturers.

“For example, United Rentals does not rent cranes but in China if a rental company has a good relationship with a manufacturer that produces cranes they may consider renting them.”

Overseas aim

In addition, Chinese renters will set up their own offices overseas, rather than expanding there through acquisition.

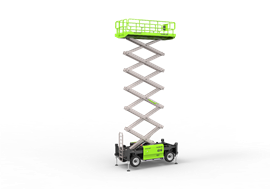

The ZS2023ERT electric scissor from Zoomlion. (Photo Zoomlion).

The ZS2023ERT electric scissor from Zoomlion. (Photo Zoomlion).

And, in doing so, they will form similar alliances. “The big rental companies going to Southeast Asia and Africa, or other territories, will follow the manufacturers there and set up their rental fleets.”

Telematics and big data are another way for manufacturers and rental companies to interact with each other. “They will work closely together and develop jointly.”

Looking at the overseas market, Chinese manufacturers are in a transitional phase too, with globalisation being the key.

“I see globalisation as meaning that we set up R&D, manufacturing and service centres in the overseas market and through this achieve localisation.”

“We will transform ourselves into a localised company.”

No doubt the tariffs imposed on Chinese MEWPs entering the EU has caused issues, however the outcome will be positive.

“We have many European clients - they are very satisfied with our products and services, but because of the tariff the customers are wondering what will happen next.

“Some of them have been hesitating buying and are waiting to see what will happen. They are thinking about the long-term plan, so the tariff has an impact.”

Unsurprisingly Zoomlion takes a dim view of the reasoning behind the tariffs. “Dumping means selling your equipment in the export market at a price lower thatthan in the domestic market. But for us it’s not the case - the equipment price is more or less the same in Europe considering the configuration difference.

“People say we have low price equipment compared to manufacturers in some other countries but that is because we have an efficient supply chain.”

Considered steps

As LiuGong openly concedes, the company has come quite late to the powered access market and it has no plans for meteoric growth, mainly due to the slowdown in the domestic market and the challenges that exist overseas. Yet it believes in the long term these factors will play to its advantage.

Li Ying, managing director of LiuGong Access.

Li Ying, managing director of LiuGong Access.

LiuGong Access was launched as a standalone division within the group at the beginning of January in 2021, with its own factory, based in Zhenjiang.

Now, under the leadership of managing director Li Ying, LiuGong Access is aiming to become a presence in the global access equipment market, having already established itself as the sixth largest manufacturer based in the country.

One of the reasons that LiuGong is already in sixth position in China, says Li, is thanks to its ability to produce boom sections through its wider manufacturing portfolio. “Many manufacturers can produce scissor lifts but not all of them can produce boom lifts.”

The new plant already has the capacity to produce 12,000 scissors per year, plus a newly completed boom facility will allow an output of 5,000 units annually. And, if there is demand required, production output could be stretched by another 20-30%.

“The market in China is too crowded, so we don’t have a major expansion plan at the moment,” says Li.

Its main focus will be on small to medium sized rental companies in China, of which there anything up to 3,000 as it stands.

“Initially it is difficult to compete with the top rental companies as they have set up alliances with the top five manufacturers”

Li adds, “We don’t want to compete on very low prices. So, we will knock on the door of each small rental company, and will continue in this way.”

LiuGong’s Access for all to see from the adjacent highway.

LiuGong’s Access for all to see from the adjacent highway.

Having said that, the company has achieved growth since its inception, with revenue doubling each year.

Steady growth

Unsurprisingly, growth remains a goal. But, says Li, “We have to be modest.” This is why the company is not fixated on taking on the largest manufacturers, rather there is an emphasis on quality and developing service.

Now the company has a range of slab scissors and boom lifts from 14-38m working height.

LiuGong will also focus on development of large working height booms, this year with 40m-60m models, and next year will consider a 70m boom.

RT and crawler-based scissors will follow that to expand on the company’s existing 12m platform height RT scissor and 16m platform height RT scissor. That’s together with the 10m-14m compact articulated booms under development.

Another emphasis is on safety. LiuGong has just upgraded its wider safety systems to a 2.0 version that will see all mechanical elements switching to digital with all the related sensors, etc.

While Li is clear about the direction of the division, there are challenges around the small to medium sized rental companies LiuGong is focused on.

Cash flow is one problem, in a market with such low rental rates smaller companies are forced to take very long repayment terms.

Rental future

Li believes that in the next five years up to 50% of China’s current rental companies will no longer be in operation. “They may not go bankrupt but may choose to sell their fleet to other rental companies or age their equipment. You can see it happening now, many companies have stopped buying new equipment and will gradually move out of the industry.” Li adds, “This actually might be good for the industry long-term.”

The production facilities for the LiuGong Access division.

The production facilities for the LiuGong Access division.

One thing is for sure, to remain strong an OEM must be selective about their customers. “We undertake accreditation before we sell equipment, to ensure they are not a high-risk client.”

On the other side of the coin, new, small rental companies with a healthy cost structure in place are the ideal partners for LiuGong. “This is part of our strategy - to work with these companies and therefore grow with them.”

Strong growth for any company in the Chinese market is currently out of the question. “It’s impossible to grow in the domestic market – which will be flat in the foreseeable future.”

Indeed, some industry forecasters believe the domestic MEWP sector will decrease over the next two years and only return to positive growth in 2027, or later.

“Therefore, to reach growth targets we must increase international sales.”

One way to achieve this is, through product, will be to move into the telehandler market. A 14m telehandler is in development now. While a prototype is already ready for this model, another 7m model is in the earlier stages of development.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM